Smarter than Harvard?

When Consilium monitors the performance of its recommended portfolios it relies on a continuous focus on benchmark returns. We always want to know that investors are getting an appropriate amount of return for the risks they are taking. But what if that’s missing the point? What if there are investment strategies beyond those employed by Consilium that are simply much smarter?

Well, in the academic world, they don’t come much smarter than Harvard Universit. And, as it happens, Harvard also knows a thing or two about investing.

Harvard University has a US$58 billion endowment fund. That’s a lot of money. KiwiSaver, which has been around since 2007 and enjoys regular positive inflows from thousands of investors has total assets of around NZD 100 billion. At current exchange rates, that puts all the money in KiwiSaver at about US$60 billion. So, the Harvard endowment is big, very big.

The endowment helps pay for the significant running costs of the university as well as research grants, scholarships and student hardship support.

Partly due to its size and profile, the Harvard endowment is often referred to as something of a benchmark investment fund. They have an incredibly experienced investment team and, in the endowment space, they were relatively early adopters of alternative assets like venture capital, private equity and hedge funds. In fact, whenever Harvard’s headline returns are strong, it is often inferred that these kinds of allocations are a key ingredient in helping Harvard achieve greater investment returns.

It makes perfect sense, right? Harvard have the clout (and the cheque book) to be able to allocate assets to whatever money managers they want around in the world. And that’s exactly what they do. They have thousands of underlying strategies in the endowment and many of these are only available to ‘the Harvard’s of this world’ – i.e. very large, institutional investors, who can meet the sizable minimum investment amounts. It’s the sort of access to investment “smarts” that most mum and dad investors can only dream about.

However, unlike dreams, access to many of these strategies is far from free. Hedge funds, for example, are often touted as attracting some of the smartest investment managers in the world. That may be true, but it needs to be for hedge funds to justify charging investors an annual fee of 1-2% (sometimes more). And even if the hedge fund manager is very smart, a 2% fee is an extremely high hurdle to overcome every year for the fund to be able to beat the returns of a much simpler, low cost diversified investment fund.

After all, it’s not like hedge funds invest in the high return markets and everyone else invests in the low return markets. We all have the same underlying investment opportunity set. It’s the individual investment decisions that hedge funds take (and the fees they charge) that ultimately differentiate their performance.

So, Harvard have a massive investment fund, they employ highly experienced investment professionals to make their asset allocation decisions, and they can invest in pretty much any strategy they want. Clearly, with all that going for them, they must be delivering investment returns we can only be envious of, right?

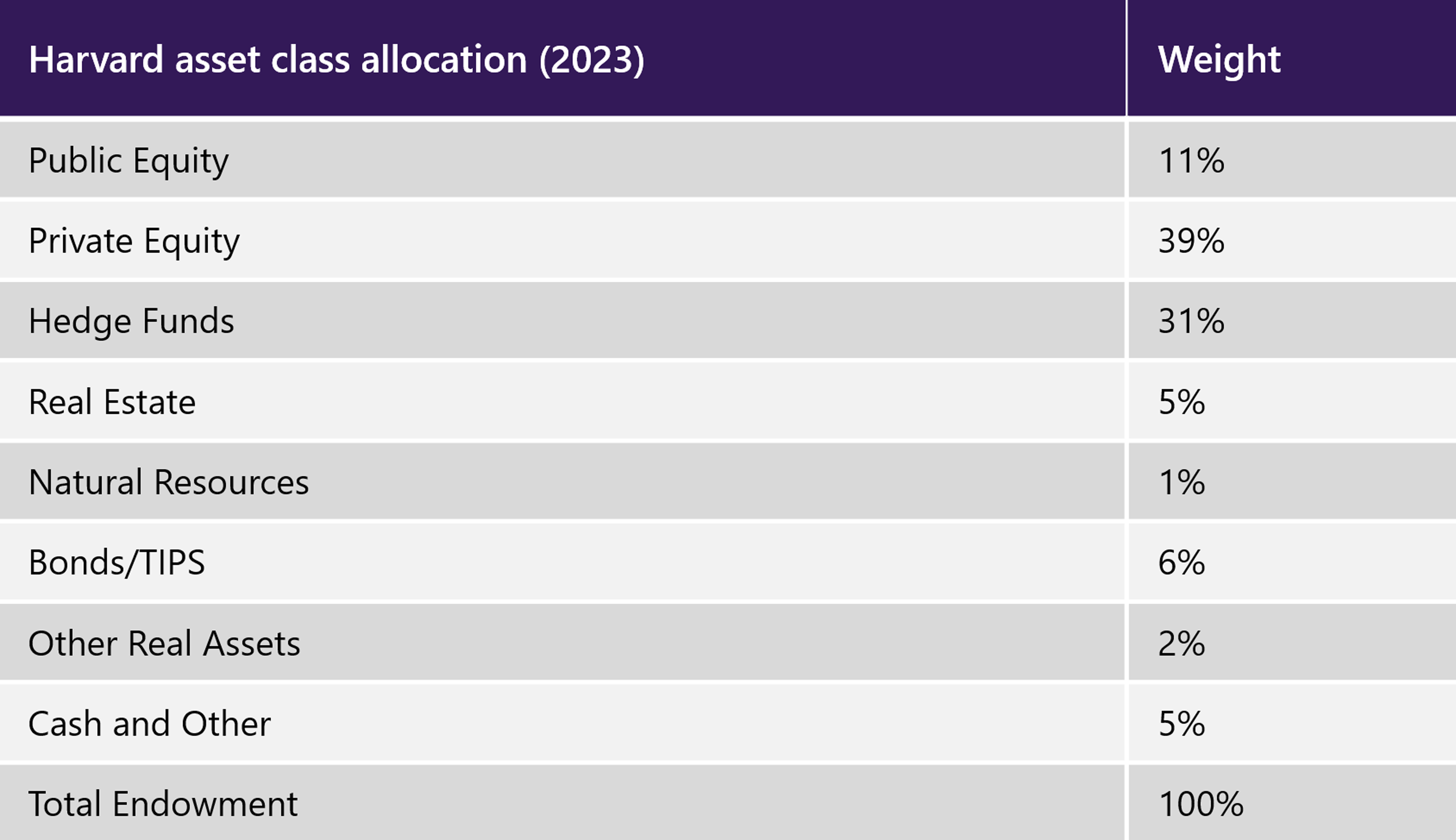

Well, let’s first examine the current Harvard portfolio mix below:

A quick look at Harvard’s asset allocation shows a heavy emphasis on private equity and hedge funds, and an overall asset allocation of approximately 90% growth assets and 10% income assets. The fact that this long term investment portfolio should have a high exposure to growth assets is no surprise, it just helps us to understand how we should attempt to benchmark its returns. While the precise asset allocation of the Harvard portfolio has moved around quite a lot over the years, the allocation to growth assets has typically always been close to 90%.

So how has this strategy performed over time?

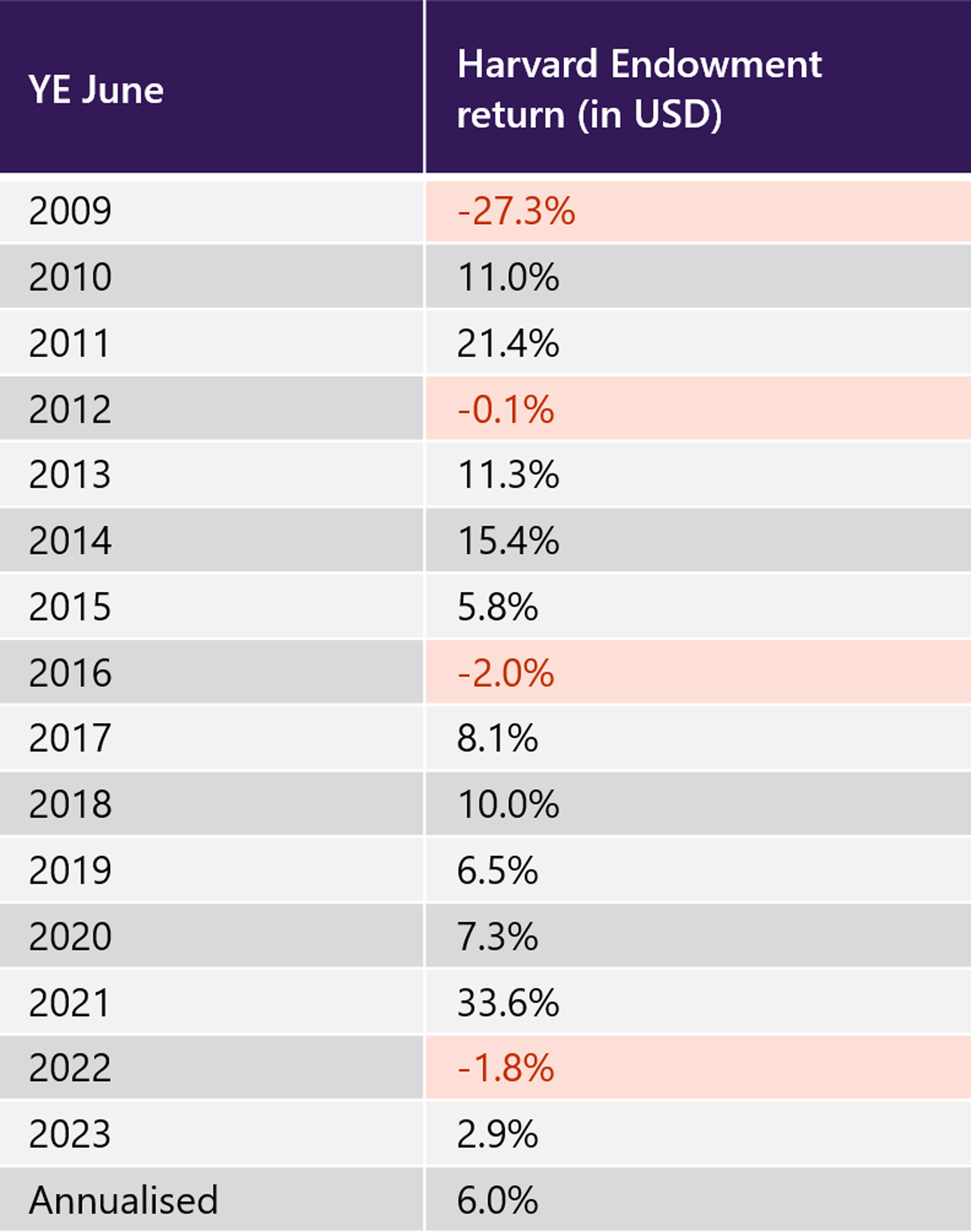

We’ve been able to get the last 15 years of Harvard Endowment returns (with Harvard reporting returns to the end of June each year). This takes us back to 2009 which includes the market low point from the Global Financial Crisis (GFC). Given Harvard’s propensity for allocating to hedge funds, this still seems like a reasonable starting point as any kind of effective “hedge” in the portfolio should have come in very handy in 2009.

Harvard’s reported returns, after all management expenses, have been as follows:

On the surface, this looks okay, particularly when we note the complete period includes both the tail end of the GFC and the years from 2020 to 2022 when Covid-19 was having a significant impact on markets.

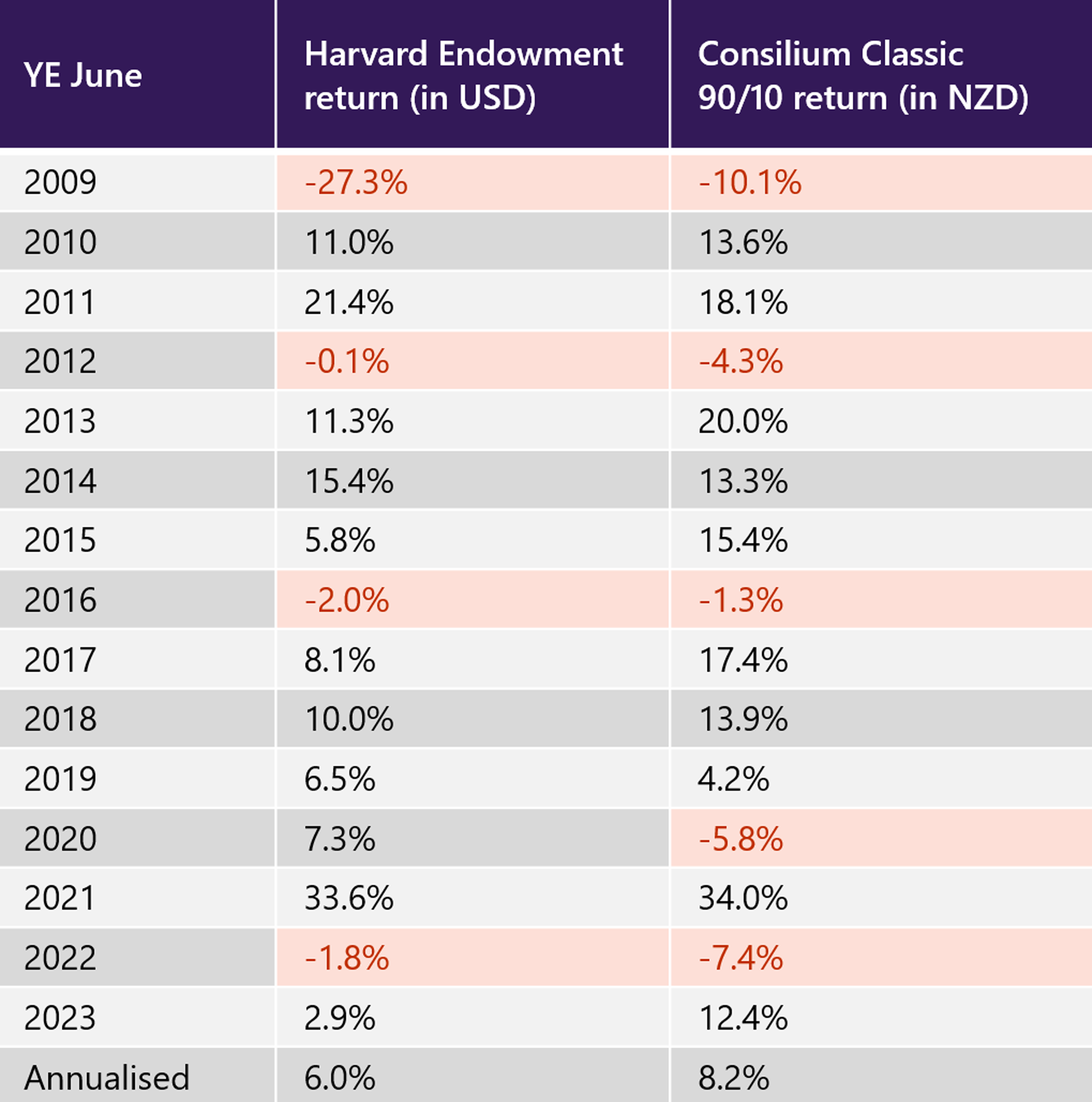

Out of interest, we wondered how these returns might compare to the returns of a Consilium Classic 90/10 portfolio over the same period. Our asset allocation approach is understandably quite different. We don’t allocate to private equity or hedge funds, but our portfolios take targeted risk exposures and we are always mindful of keeping ongoing investment costs as low as possible.

The returns comparison, after fund management expenses, looks like this:

Setting aside the fact that Consilium Classic returns are in New Zealand dollars and the Harvard Endowment returns are in US dollars, what we see over this 15 year period is that the Consilium Classic models have delivered a superior reward to investors in New Zealand, than the Harvard Endowment has been able to deliver to the Harvard University.

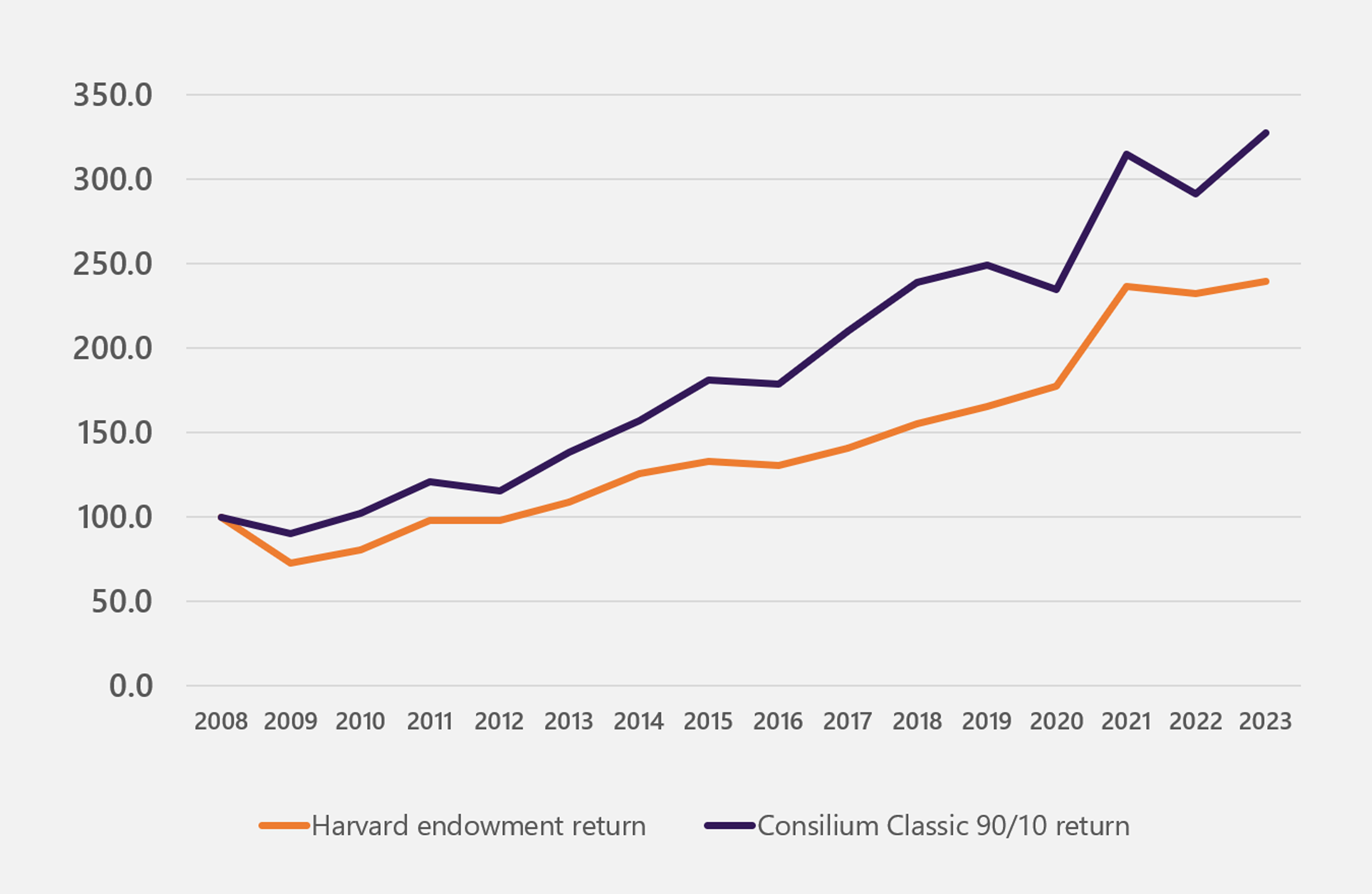

And these return differences really add up, as the following relative growth of wealth chart highlights.

Growth of wealth in home country

We can’t say that that the Consilium Classic models are “smarter” than Harvard’s without a lot more information, but what the last 15 years of data suggests very strongly, is that –

- Bigger (Harvard) is not always better

- Less transparent and harder-to-access strategies (Harvard) do not guarantee better investment returns

- A focus on cost minimisation and consistent wide diversification (Consilium) probably helps a lot

- Regular active asset allocation changes (Harvard) don’t appear to add value

At the end of the day, this comparison is an academic exercise. The Harvard Endowment is not the benchmark for Consilium Classic models, even though it is always insightful to see and understand what a different investment approach can (and does) deliver.

When markets are challenging and investment performance ebbs and flows, advisers and investors are only being human if they wondered whether there was a better way to invest.

What’s heartening is that when we look back at the investment returns generated by one of the biggest and most well-resourced investment programs on the planet, we can see that investor’s in Consilium Classic models are not being left behind. In fact, they can feel reassured about the quality of their long term returns.

Smarter than Harvard? Probably not.

Portfolios delivering smart outcomes for New Zealand investors? Definitely!